Recent economic recovery has created a lending environment that is far more hospitable to the millennial age group (those born 1980-1999) than any we have seen in the past several years. The re-emergence of products like mortgages with loan-to-value ratios of 85-90%, lender paid mortgage insurance, and mortgages to borrowers who are shouldering debt-to-income ratios of up to 50%, have allowed for many more people to enter the home buying discussion. These products are particularly advantageous to millennial home buyer hopefuls, who have often been kept out of the market because of large amounts of student debt and/or because sky high rental prices have prevented them from saving enough for a down payment.

Millennials are also disproportionately benefiting from the recent job growth. According to Realtor.com chief economist, Jonathan Smoke, the under-35 population has seen job growth at a 60% better pace than the rest of the population.

Largely due to the reasons listed above, forecasts released by both Realtor.com and Zillow suggest that millennials will be making their triumphant return to the housing market next year. Realtor.com predicts that millennials will make up around 65% of first-time home buyers in 2015, and Zillow chief economist Stan Humphries said in a report released Tuesday that, “roughly 42% of millennials say they want to buy a home in the next one to five years compared with just 31% of generation X.” He also went on to claim that by the end of next year millennials will be the largest home-buying age group.

Unfortunately, those of us living in the SF Bay Area will probably not play much of a part in the return of the millennial home buyer. It is expected that low inventory will continue to drive up home prices, making it difficult for first time buyers to enter the market. Even so, loosening mortgage requirements and continued job growth should set the stage for Bay Area millennials at some point down the road. And with rental prices as high as they are, first time buyers should consider buying sooner rather than later, so they can start investing their monthly payments rather than handing them to a landlord.

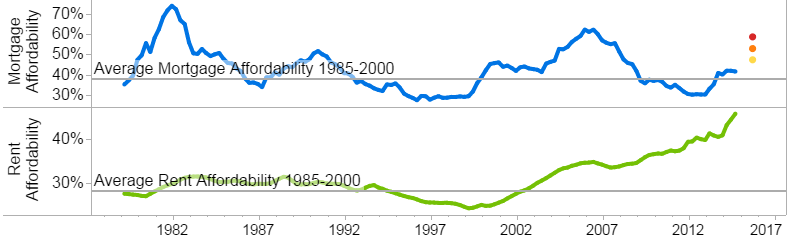

The graphic below shows the rent and mortgage affordability for San Francisco as calculated by Zillow. As you can see, the difference between the two is negligible.

No comments:

Post a Comment